The bright spot in the New Zealand economy

- Latest GDP figures show that food and fibre is one of the few bright spots in the New Zealand economy right now.

- MPI’s latest analysis forecast that food and fibre industries are set to continue to perform strongly.

- To sustain this growth, the sector needs a skilled and productive workforce – Muka Tangata are working with the sector to build the pipelines of skills that industry needs.

Food and fibre shows the strongest growth in the last quarter

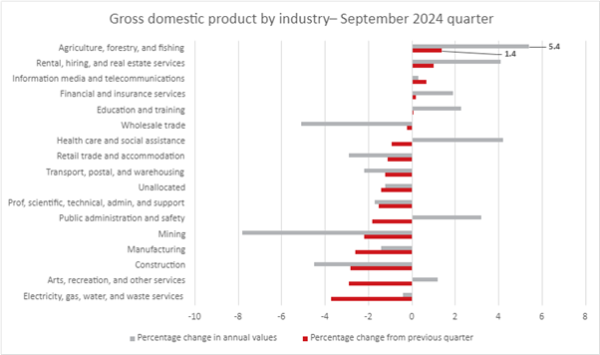

Source: Stats NZ

As we look back on the outputs of Aotearoa New Zealand’s food and fibre sector over the past six months, there is a picture of growth for both GDP and export revenue across the sector. Stats NZ’s September 2024 quarterly report shows a 1.4% increase in GDP for Agriculture, Forestry and Fishing. This was driven by dairy cattle farming, horticulture, and fruit growing.

MPI forecasts a strong outlook for exports

The Situation and Outlook for Primary Industries report is released by Ministry for Primary Industries twice a year and provides an update on the export performance of Aotearoa New Zealand’s food and fibre sector. The December 2024 update provides a forecast of the year to 30 June 2025 and highlights the importance of the food and fibre sector to our economy and shows the continued strength and adaptability of the sector over time.

Some key takeaways include:

- Stronger global demand and tighter global supplies for key commodities are contributing to the expectation that food and fibre sector export revenue will bounce back by 7 percent to $56.9 billion in the year to 30 June 2025.

- The food and fibre sector made up about 81% of New Zealand’s goods exports in the year to 30 June 2024.

- Between 2018 and 2023, the asset base of Māori collectives operating in the food and fibre sector increased 35%, with a worth of $19 billion in 2023.

Some key issues affecting the food and fibre sector include:

Cost pressures

Food and fibre producers may start to experience an easing of cost pressures on margins and profits due to higher prices and low input cost inflation. Input costs saw a 20% increase from the September 2021 quarter to the September 2023 quarter, but the farm expenses price index remained stable between the September 2023 quarter and September 2024 quarter. Nonetheless, farm expenses are still high.

La Niña weather patterns predicted

Weather patterns have been difficult for farmers, with some areas experiencing drier than normal conditions, and others experiencing quite wet conditions. NIWA is predicting a weak La Niña event for the end of 2024, which usually brings wetter conditions in parts of the North Island, and drier conditions in parts of the South Island. January 2025 is forecast to be drier than what would normally be expected for La Niña. However, this should be short lived with a shift to average or better weather conditions likely to remain.

Strong Growth in Māori food and fibre sector

Early data for Te Ōhanga Māori economy report (due to be released early 2025) shows that the Māori economy in the food and fibre sector is growing. Sheep and Beef are the largest asset class ($7.2 billion in 2023) for Māori collectives operating in the sector, and the Māori collectives’ asset base in the fishing and aquaculture industry is worth $2.3 billion. However, this early data from the report indicates that Māori collectives operating in the food and fibre sector are shifting towards horticulture, dairy and forestry – these saw the biggest growth in the Māori collectives’ asset base in 2023.

What does this mean for VET and the food and fibre workforce?

Recent data shows that the primary industries are continuing to add new jobs to the labour market, compared to an overall loss across all sectors. The last 9-12 months have started to see a positive shift, with an easing of cost pressures, despite the last couple of years resulting in reduced profits due to declining export prices and rising costs across some primary industry sectors.1

This may be due to more of a scarcity of jobs in urban centres, which means more people are open to looking for roles in rural areas. This makes it easier for farmers to hire the calibre of workforce required for the job.2 This is great news for the government’s goal to double exports by value in 10 years, with primary industries playing a key role in this target.

Muka Tangata will continue to support the food and fibre sector through this growth, by working alongside our industries to ensure they have the skilled workforce needed to meet the government’s export targets. This has been reflected in our 2026 investment advice to the Tertiary Education Commission (TEC), and our submission to TEC and the Ministry of Education on the redesign of the vocational education and training system.

We are currently developing a Skills Forecasting tool that allows us to track projected changes in the workforces across food and fibre industries, and their skills and training needs, over a 50-year period. From early 2025, we will be working with industries to forecast the skills and training needs of their industries to meet the growing demand.