2026 Investment Advice

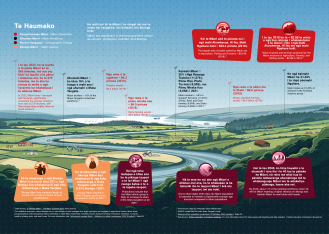

Muka Tangata provides advice to TEC on investment in vocational education to influence funding decisions that considers industry needs, to help match skills and workforce demands with supply.

Learn moreSupport Services represents the largest grouping of employees across the food and fibre sector.

There is no single ‘overall’ industry picture but instead a diverse set of challenges which makes it difficult to identify the best way to engage with industry.

Our picture of the industry is limited, and we need better data and information to understand the various groups.

Key Challenges

View the Arboriculture industry dashboard, including learner enrolments and workforce data for Arborists here: Arboriculture industry.

Find out about our work to assess the quality of programmes delivered by providers for this industry here.

A snapshot of the Support Services workforce development plan is available for download here. Please note that this reflects a point in time (July 2024). The most up to date information is on the workforce development plans website.

Muka Tangata provides advice to TEC on investment in vocational education to influence funding decisions that considers industry needs, to help match skills and workforce demands with supply.

Learn more

This section provides information about the workforce, industry and Vocational Education and Training (VET) provision and performance. It shows data and research focused on key aspects of Muka Tangata industry groups and learners. This section is expected to feature regular updates to the data and trends being showcased.

Insights for Industry about trends in economic performance indicators.

Insights on the workforce, including; size, ethnicity, age, regional distribution, and gender.

Insights about learners, including trends in enrolments and mix of provision.

The Support Services industry group covers a large variety of industries, and makes up the largest number of people in the food and fibre workforce. There are common opportunities across the diverse range of industries. Qualifications are limited and, in some cases, are not aligned with more recent government strategies and plans - It is not uncommon for informal training to fill the gap.

Many of the roles in the industry require specific skills and often seasonal schedules and remuneration varies across the different sub-industries. There is not a lot of flexibility to easily move between the sub-industries. In some cases, these factors can also make it difficult to attract and retain people in the industry. More specifically, the pest control industry has a few challenges with existing training. The existing formal qualifications for pest control do not have mātauranga Māori well embedded in them and are not aligned with the Predator Free 2050 goals of the Department of Conservation.

As part of our mahi, we are supporting Toi Mai in their conservation work in relation to pest control so that there is a common view for a workforce that spans across sectors. You can find out more about this project on the Toi Mai website.

This is our plan to address the vocational education and training opportunities that arose from our engagement, research and analysis. It includes real projects that we are committed to delivering, with most of these spanning across some or all Muka Tangata industries. Our Projects have replaced our previous “Roadmap Actions” and present a consolidated view of our mahi. Some of the previous roadmap actions have been completed or closed out following a review of our work programme and engagement with industry on the priority of these actions.