Our Sheep, Beef, Deer and Wool Workforce Development Plan contains further analysis of Industry, Workforce and Learner data trends.

Sheep, Beef, Deer and Wool industry trends

The industry is a significant contributor to our sector’s exports but has faced significant challenges and is forecasting a slight decline in export revenue. The industry is dealing with significant changes from regulation, environmental business and technological changes. These all drive the need for new skills to be brought into the sector.

The industry collectively made up 23% of export revenue for the food and fibre sector in the year ending June 2022, with a total of $12.3 billion. Beef, veal and lamb were the highest contributor to this revenue (66%), with carpets and other wool products contributing the least (<%1). Overall export revenue for Sheep, Beef, Deer and Wool has fluctuated over the last couple of years, seeing some increases despite the hectarage of sheep and beef farms decreasing, but is forecasted to decline slightly through 2024. The Sheep, Beef, Deer and Wool industry is facing the pressure of keeping up with rapidly changing farming systems due to changing technologies, new ways of farming, and external pressures and regulations1 .

Sheep, Beef, Deer and Wool workforce trends

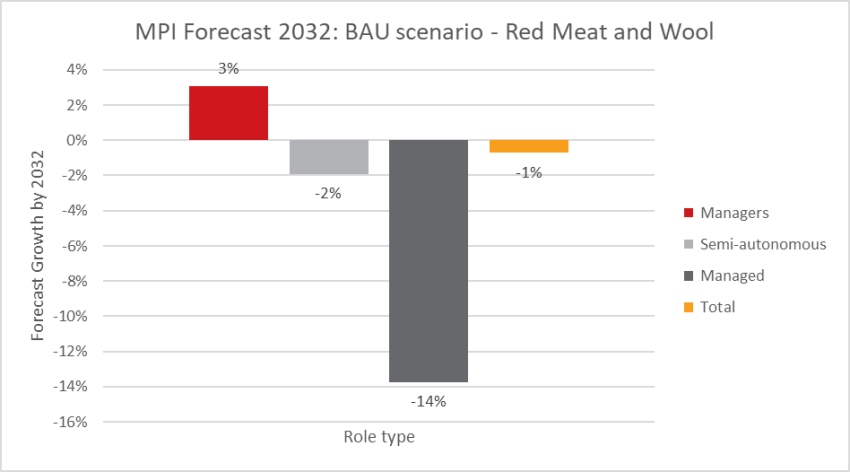

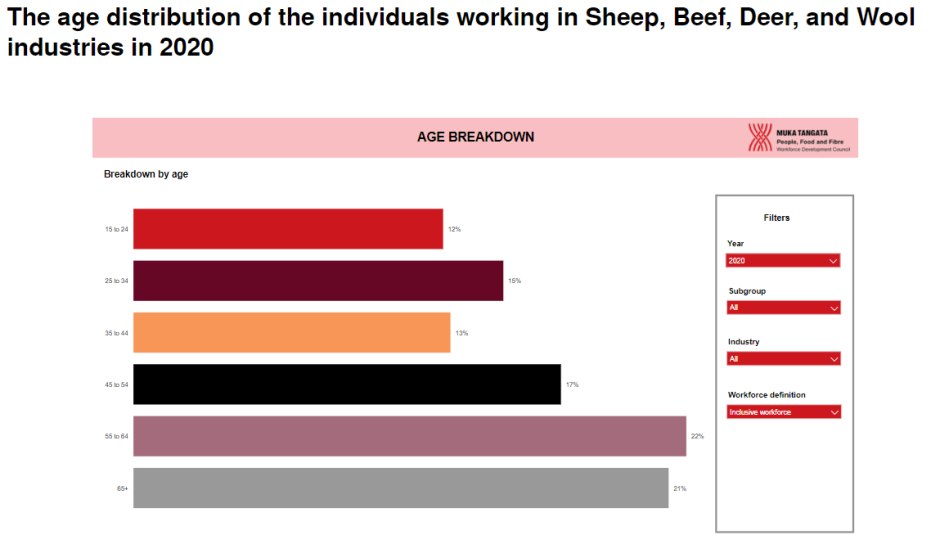

Top level: The industry is facing an aging workforce and is looking to how to support a replacement pipeline of workers and upskill existing workers to move into roles as experienced workers age-out from the workforce. The ‘Red Meat & Wool’ sector workforce as a whole is forecast to decrease by 1% by 2032 but is forecasting an increase in higher skill role types that will require increased levels of training. The workforce currently has low levels of formal qualifications and would need a substantially higher than requested level of investment to reach industry benchmark parity (see Appendix C for more detail on the methodology).

Sheep, Beef, Deer and Wool workforce overview and highlighted demographics

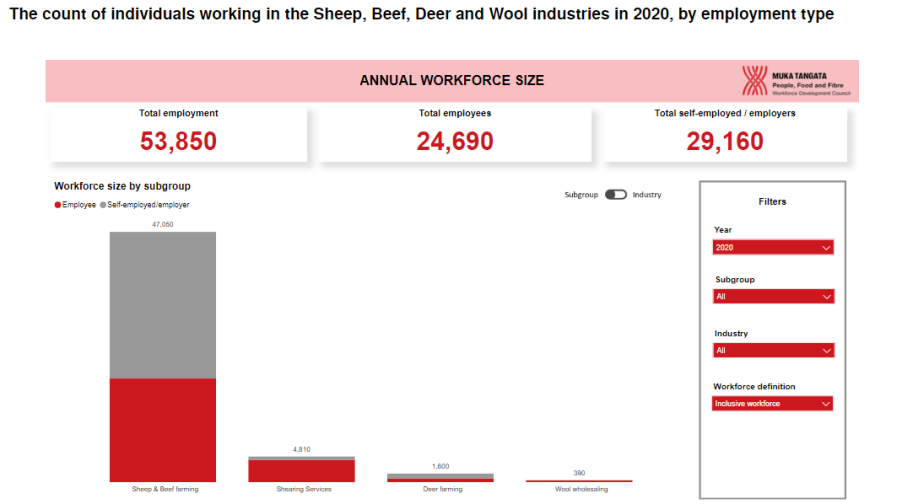

In 2020, 53,850 people worked in the Sheep, Beef, Deer and Wool industry, with 87% working in Sheep and Beef farming. The industry is facing an aging workforce – 21% of workers were aged 65 or over in 2020. Across the industry, 17% of the workforce identified as Māori in 2020, but in Shearing Services this is much higher, with 65% of the workforce identifying as Māori in 2020. In 2020, 36% of the workforce identified as female, which is similar to the percentage of the workforce identifying as female across all Muka Tangata industries.

Sheep, Beef, Deer and Wool workforce forecasts

MPI forecasts, using the conservative ‘BAU Scenario’ for ‘Red Meat & Wool’ sector workforce as a whole, is for a decrease by 1% by 2032 but is forecasting an increase in higher skill role types that will require increased levels of training. We have mapped these forecasts to the roles and related qualifications for each of our industries and used them as an input to the level of increase requested for each qualification. See Appendix A: Translating MPI workforce forecasts to learner enrolment numbers for more details.