Our Nursery, Turf and Gardening Workforce Development Plan contains further analysis of Industry, Workforce and Learner data trends.

Nursery, Turf and Gardening industry trends

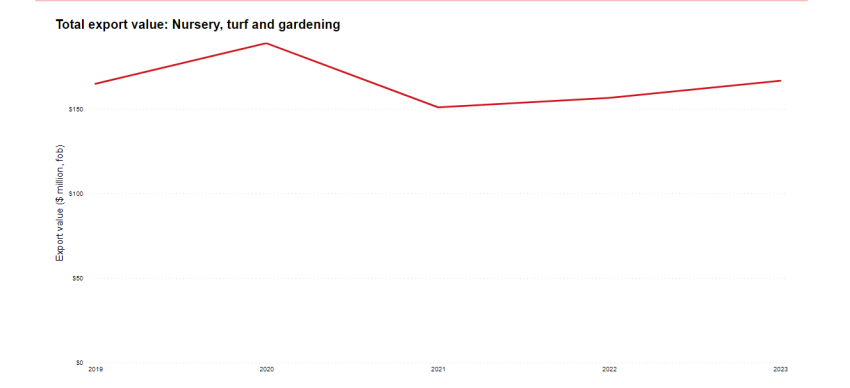

The industry was significantly impacted by Covid with steep reductions for exports – particularly for cut flowers and foliage though exports for Seeds have recovered.

Nursery, Turf and Gardening is a Muka Tangata industry grouping which includes Nursery Production, Turf Growing, Gardening Services, and Floriculture Production. This also includes sub-industries such as Amenity and Sports Turf and encompasses a variety of roles from green keepers to native plantings. It does not include fruit or vegetable production, which are two separate industry groupings. Seed production for flowers and foliage also falls into Nursery, Turf and Gardening, but it does not include vegetable seeds, which are part of the Arable industry. There is a long-term downward trend in export revenue from cut flowers and foliage. Covid had a significant impact on the export of cut flowers and export revenue for 2022-20203 is nearly half of what it was for 2018-2019 ($25 million). The export value for seeds has bounced back since covid and exceeded 2018-2019 export values to reach $147.8 million in 2022-2023 which represents 67.3% of exports for cut flowers, plants, seeds, bulbs, and moss.

Nursery, Turf and Gardening workforce trends

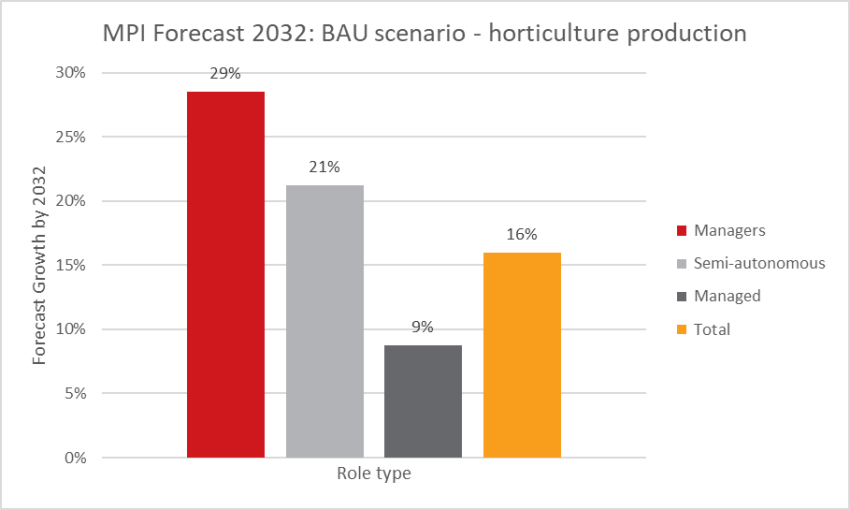

The workforce has started to rebound from disruption posed by Covid though is still vulnerable to recent weather disruptions and some industry groups, like Sports Turf, have shown increases. The horticulture sector workforce as a whole is forecast to increase by at least 16% by 2032 with increases being particularly concentrated in higher skill role types that will require increased levels of training. The workforce currently has low levels of formal qualifications and would need a substantially higher than requested level of investment to reach industry benchmark parity (see Appendix C for more detail on the methodology). The workforce has low new entrant retention rates and low levels of industry tenure which drive a need for training of replacements.

Nursery, Turf and Gardening workforce overview and highlighted demographics

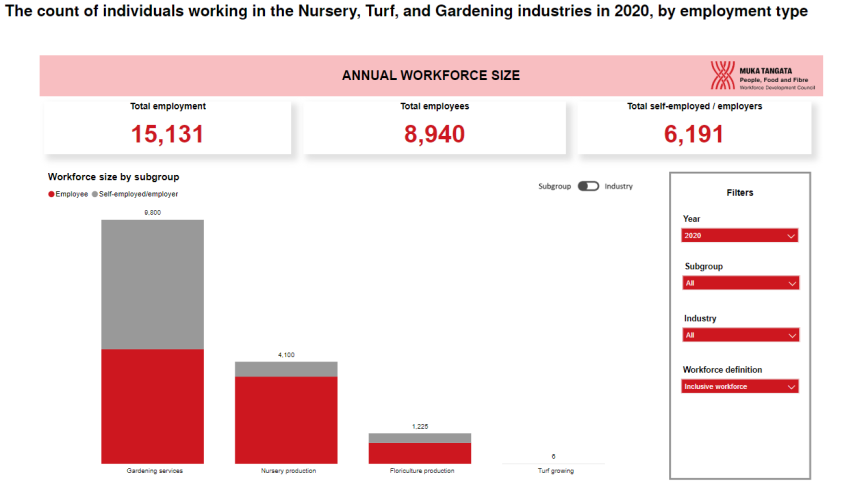

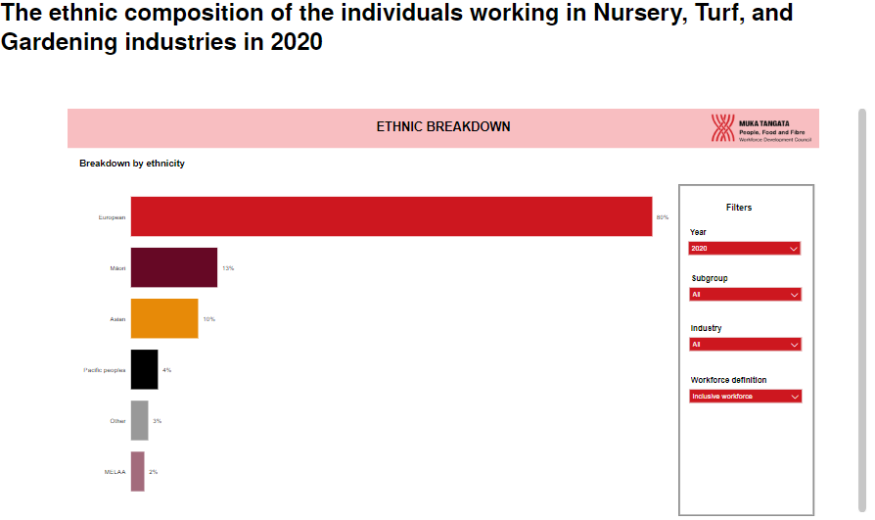

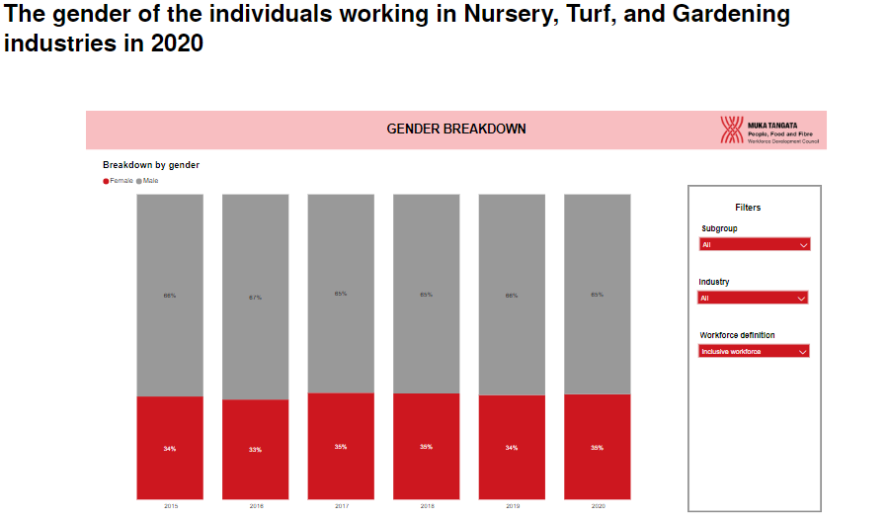

In 2020, 15,131 people worked in Nursery, Turf and Gardening, with Auckland and Canterbury being key regions across the industry. Although variable amongst the different sub-industries, Nursery, Turf and Gardening has a primarily European workforce, with 13% of the workforce identifying as Māori and 10% identifying as Asian in 2020. In the same year, 33% of the workforce identified as female1.

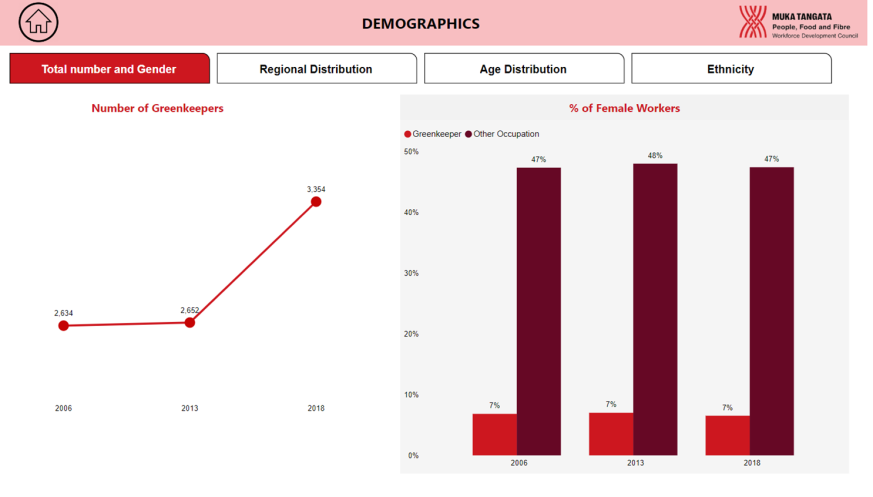

The Sports Turf industry workforce is not well represented using ANZSIC data2 but recent analysis3 using Stats NZ Occupation codes and qualifications data shows that the Greenkeeper workforce numbers have been increasing. Learner numbers for Sports Turf qualifications and programmes are also increasing, driven by growth in apprentices, though remain below historic trends.

Nursery, Turf and Gardening workforce forecasts

MPI forecasts, using the conservative ‘BAU Scenario’, are for an increase in worker numbers – particularly in higher skill level roles We have mapped these forecasts to the roles and related qualifications for each of our industries and used them as an input to the level of increase requested for each qualification. See Appendix A: Translating MPI workforce forecasts to learner enrolment numbers for more details.

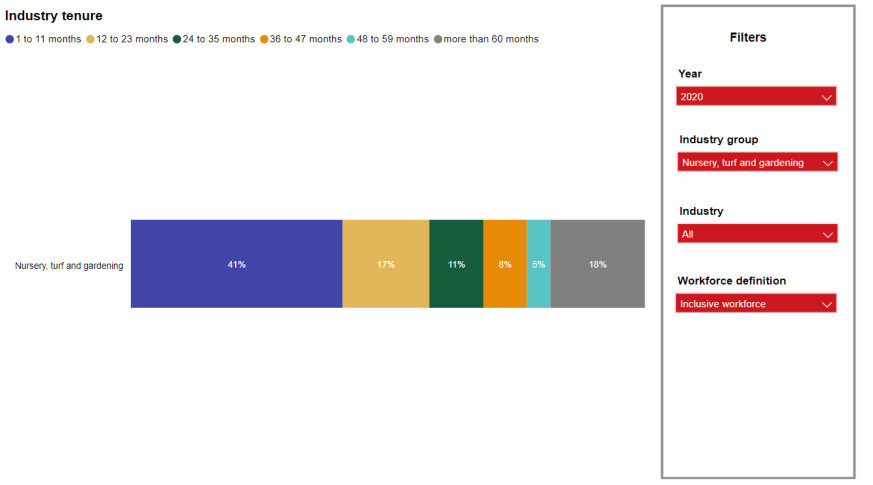

Nursery, Turf and Gardening workforce retention and tenure

The Nursery, Turf & Gardening workforce has a low level of new entrant retention and a low level of industry tenure. This replacement demand also is a driver of training requirements in this industry. This training is not lost to the sector – over a third of new entrants to Muka Tangata industries come from another Food & fibre industry and our qualifications are increasingly focused on transferable skills. Specialised education and retention are associated with retention – so increased training is expected to support retention within the industry and broader sector.

Footnotes

2. See our explainer paper Data Challenges for the Sports Turf Workforce

3. Forthcoming publication on the Muka Tangata Workforce Development Plans – working data (which is going through industry consultation) is available for TEC here.