Our Apiculture Workforce Development Plan contains further analysis of Industry, Workforce and Learner data trends.

Apiculture industry trends

The industry has been through a significant and rapid growth period and is now going through a period of consolidation and increasing focus on professionalisation and commercial discipline.

The COVID-19 pandemic brought with it a surge in demand for honey, particularly mānuka honey, and export prices rose significantly over 2020 and 2021, reaching an all-time high of $481 million in 20211. This was good news for honey producers, who have had successive years of high yields, resulting in a stockpiling of honey. Despite these record sales, it is estimated that there is still more than a year’s worth of honey in reserves. Congruently, the Government’s introduction of free training in the trades as part of the COVID-19 response saw student enrolments in Beekeeping sharply increase in 2020. These anomalies are already beginning to change, as exports have begun declining, and free trades training came to an end in December 2022. The number of registered beehives has also been declining, with approximately 730,800 registered beehives in 2022, compared to a peak of 918,000 registered beehives in 20192.

Apiculture workforce trends

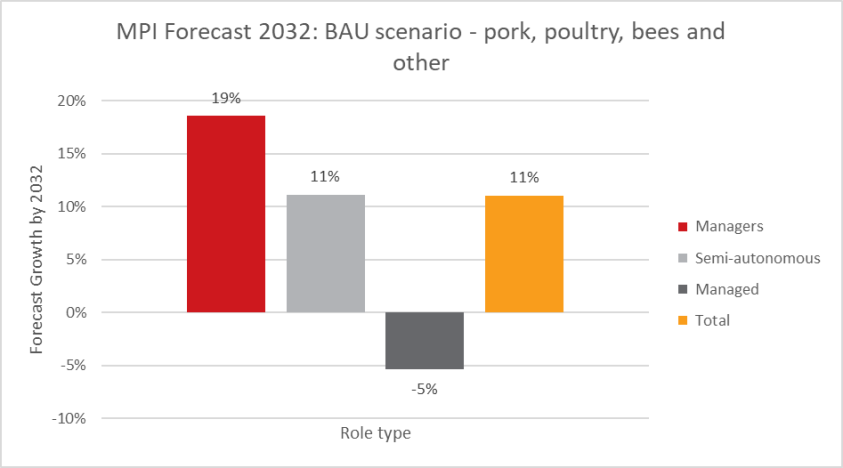

Top level: The ‘Pork, Poultry, Bees and Other Sector’ workforces are forecast to increase by at least 11% by 2032 with increases being particularly concentrated in higher skill role types that will require increased levels of training. The workforce currently has low levels of formal qualifications and would need a substantially higher than requested level of investment to reach industry benchmark parity (see Appendix C for more detail on the methodology). The workforce has low levels of industry tenure which drive a need for training of replacements.

Apiculture workforce overview and highlighted demographics

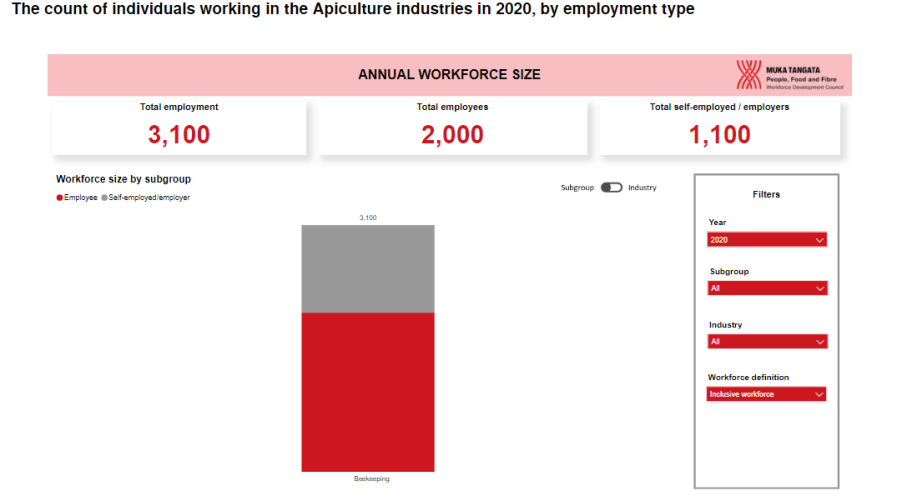

3,100 individuals worked in the Apiculture industry across 2020, with 1,100 of these being self-employed. The number of employees counted per month tends to peak in summer at around 1,800 employees and is lowest in winter (June/July). Compared to the age distribution across other Muka Tangata industry groups, Apiculture is made up of a higher percentage of workers in the middle-age bands (between ages 25-54) and a lower percentage of older workers (aged 55 or over). While the percentage of workers identifying as Māori and Asian is consistent with Muka Tangata industries as a whole, relatively few workers in Apiculture identify as Pacific peoples.

Apiculture workforce forecasts

MPI forecasts, using the conservative ‘BAU Scenario’, are for an increase in worker numbers – particularly in higher skill level roles. We have mapped these forecasts to the roles and related qualifications for each of our industries and used them as an input to the level of increase requested for each qualification. See Appendix A: Translating MPI workforce forecasts to learner enrolment numbers for more details.

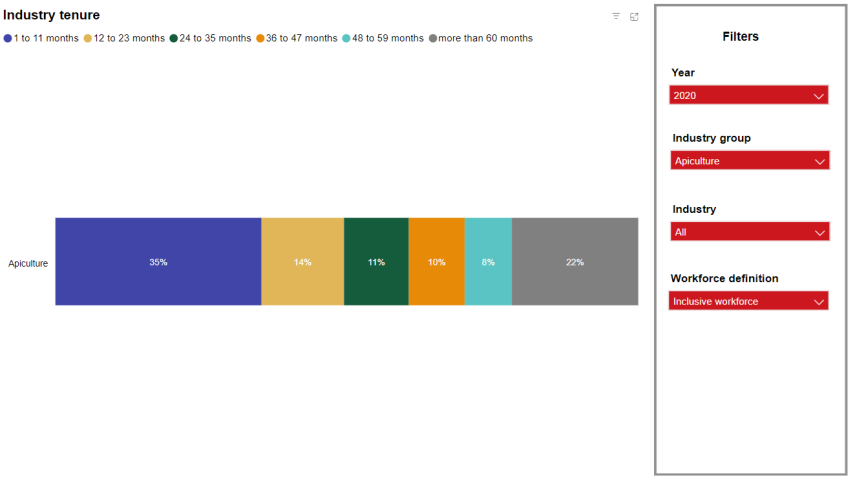

Apiculture workforce tenure

The Apiculture workforce has a low level of industry tenure. This replacement demand also is a driver of training requirements in this industry. This training is not lost to the sector – over a third of new entrants to Muka Tangata industries come from another Food & fibre industry and our qualifications are increasingly focused on transferable skills. Specialised education and retention are associated with retention – so increased training is expected to support retention within the industry and broader sector.

Apiculture learner trends

In 2021, enrolment numbers increased to 2,830 learners, with 20% of learners identifying as Māori. This is a large proportion of learners compared to the total workforce count for 2020, when we counted 3,100 people, 17% of whom identified as Māori. The number of Beekeeping learners who identify as female has been increasing since 2013, reaching an all-time high of 49% in 2021. This is quite a bit higher than the number of female learners across Muka Tangata industries more broadly and is also significantly higher than the number of people in the Apiculture workforce who identify as female, which was 31% in 20203.

Which specific qualifications and credentials do you want to see growth in (that can be supported by TEC investment in 2025)?

| Qualification or credential | Mode | Specific regions? | Scale of change you are seeking for 2025 | Evidence of workforce need – include as text below the table or an attachment | Evidence that this provision will meet the workforce need | WDC-assigned priority level (for this advice) |

| New Zealand Certificate in Apiculture (Level 3) [2223] | All regions | 0-5% |

As we indicated in our 2024 advice, this qualification seems to mainly serve 'hobbyist' apiarists. That is the feedback we have received from industry. In addition, we note that enrolments are roughly the same size as the total apiculture workforce. However, as the only apiculture-specific 'entry level' qualification it may also be used by potential entrants to the industry, including as part of complex apprenticeships. In addition, hive health (preventing the spread of varroa mite or American Foulbrood Disease) is important to the industry and formal training for hobbyists may be useful in this context. We are therefore reluctant to suggest a decrease in learner numbers, but do not want to see significant increases, and maintain our 2024 advice of prioritising on-job training if possible. |

The purpose of this qualification is to provide the apiculture industry with individuals who have the skills and knowledge to work safely and effectively as an assistant beekeeper. This qualification is for people who are either intending to work, or are working in, the apiculture industry. This includes being able to apply knowledge of pest and disease control methods to carry out beehive disease management plans |

Low Priority | |

| New Zealand Certificate in Apiculture (Level 4) [2224] | All regions – but note RSLG specifics: Taitokerau | 20-25% |

There is demand from industry driven by forecast workforce growth, significant gaps in the qualification level of the workforce and demand driven by high rates of new workers constantly needing to be brought into the industry and upskilled. The industry forecasts growth in ‘Manager’ level skills in particular and changing commercial and business trends also support demand for an industry-focused qualification that provides the skills necessary to supervise and oversee a viable apiculture business. |

Our priority in Apiculture is the Level 4 New Zealand Certificate in Apiculture. This qualification is industry focused and provides the apiculture industry with individuals who have the knowledge and skills to supervise and oversee a viable apiculture business. |

High Priority |

Which specific qualifications and credentials do you want to see changes in?

| Qualification or credential | Mode | Specific regions? | What is the change you are wanting to see? | Evidence of workforce need – include as text below the table or as an attachment |

| New Zealand Certificate in Apiculture (Level 3) [2223] | Prioritise on-job training | Prioritise on-job training | As we indicated in our 2024 advice, this qualification seems to mainly serve 'hobbyist' apiarists. That is the feedback we have received from industry. In addition, we note that enrolments are roughly the same size as the total apiculture workforce. However, as the only apiculture-specific 'entry level' qualification it may also be used by potential entrants to the industry, including as part of complex apprenticeships. In addition, hive health (preventing the spread of varroa mite or American Foulbrood Disease) is important to the industry and formal training for hobbyists may be useful in this context. We are therefore reluctant to suggest a decrease in learner numbers, but do not want to see significant increases, and maintain our 2024 advice of prioritising on-job training if possible. |

| As we note in our overarching advice, we have not been specific about mode at a qualification level. However, in general, we recommend a preference for workplace training as part of the mix of the provision across all of our industries. This could include both work-based training and campus-based learning that include a strong component of practical ‘on job’ experience in a workplace setting. |

Footnotes

2. Farm monitoring reports | NZ Government (mpi.govt.nz)