Our Vegetables Workforce Development Plan contains further analysis of Industry, Workforce & Learner data trends.

Vegetables industry trends

Despite recent disruption from weather events, industry is forecast to recover and expand – this will drive increases in training needs.

The past year has been challenging for the vegetable operators who have made a concerted effort to bring supplies to market despite the challenging weather conditions punctuated by Cyclone Gabrielle and flooding damaging roading and other infrastructure, which significantly limits vegetable production for the foreseeable future, especially in Northland and Hawkes Bay. Central and local government restrictions continue to preoccupy growers and worker shortages and growing input costs are also jeopardising food production. On the plus side, getting the Recognised Seasonal Employer (RSE) scheme numbers increased to 19,000 and working holiday visas once again being issued will help with seasonal shortages1.

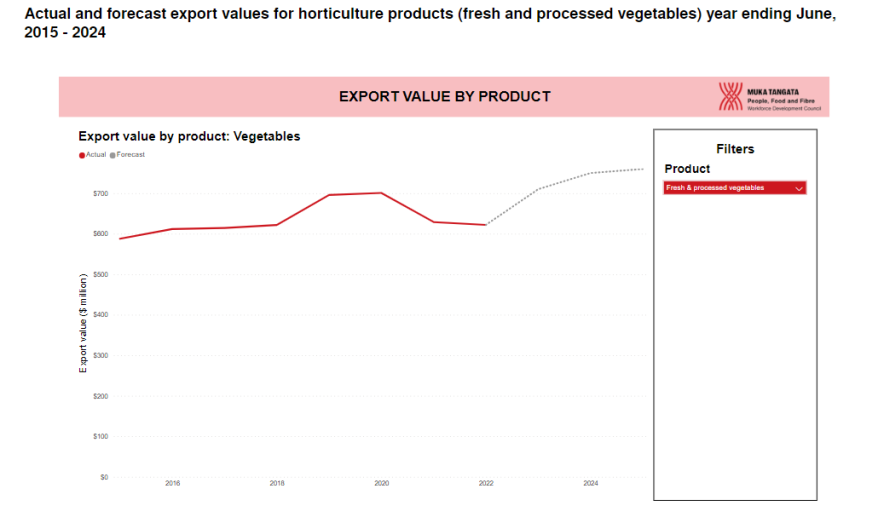

The export revenue from fresh and processed vegetables was $622 million in the year ending June 2022, a 1.9% decrease on the previous year. Whilst previous forecasts (before weather events of 2023) for vegetable growing showed a modest revenue increase, industry performance is heavily dependent on growing conditions, and exports fell because of lower volumes. 2023 is expected to have a brighter outlook with export revenue, which is forecast to increase by 15.8% to $720 million in 2023.

See Figure 2 for details of export forecasts for the vegetable sector from MPI.

Vegetable workforce trends

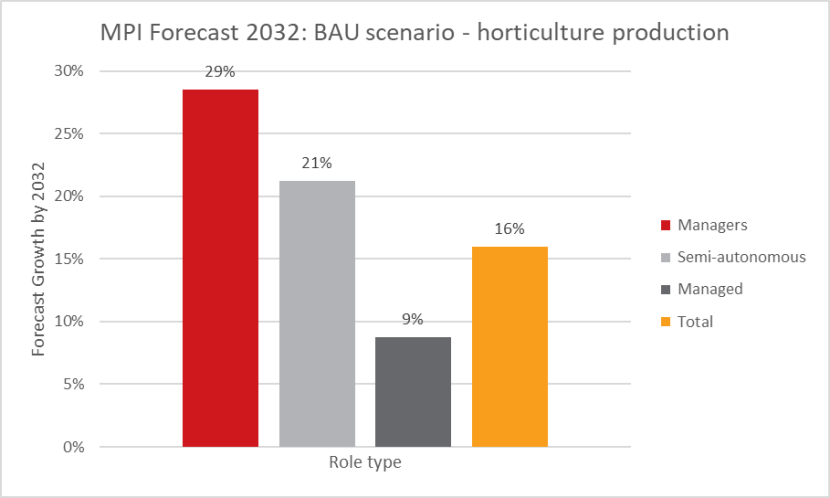

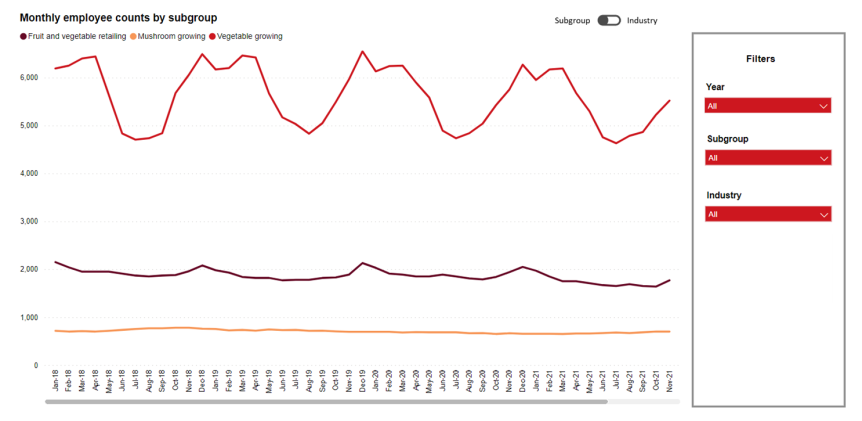

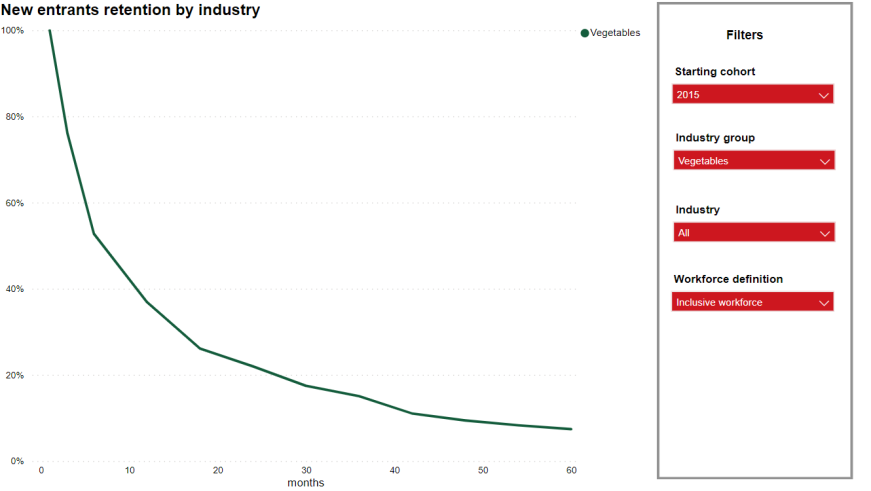

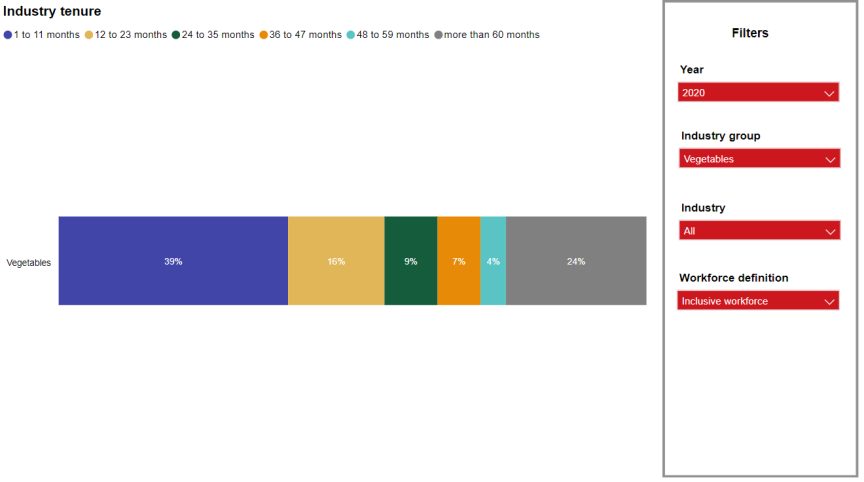

Top level: The workforce has seen modest decreases which are linked to both the industry challenges noted above and a trend towards industry consolidation. The industry has areas of high levels of seasonal variation (which affect how forecasts should be treated). The horticulture sector workforce as a whole is forecast to increase by at least 16% by 2032 with increases being particularly concentrated in higher skill role types that will require increased levels of training. The workforce currently has low levels of formal qualifications and would need a substantially higher than requested level of investment to reach industry benchmark parity (see Appendix C for more detail on the methodology). The workforce has low new entrant retention rates and low levels of industry tenure which drive a need for training of replacements. The sector has very significant reliance on those on temporary & work visas making the industry vulnerable to changes in immigration trends and policy shifts.

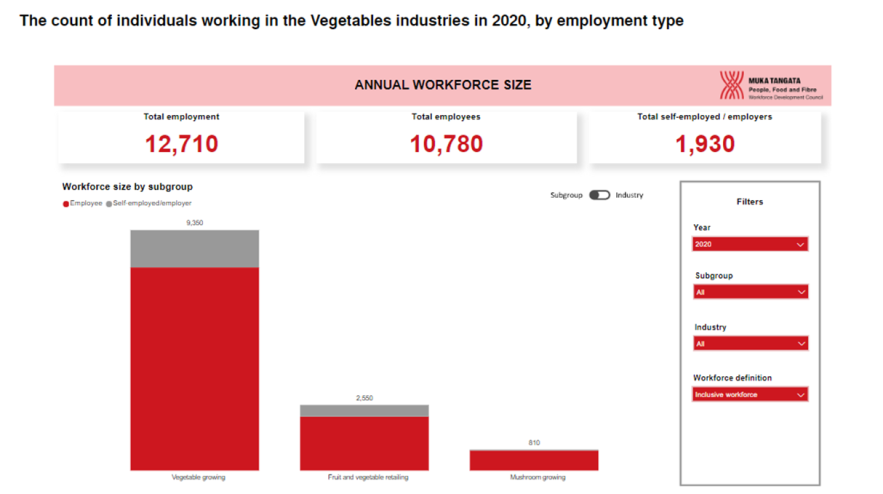

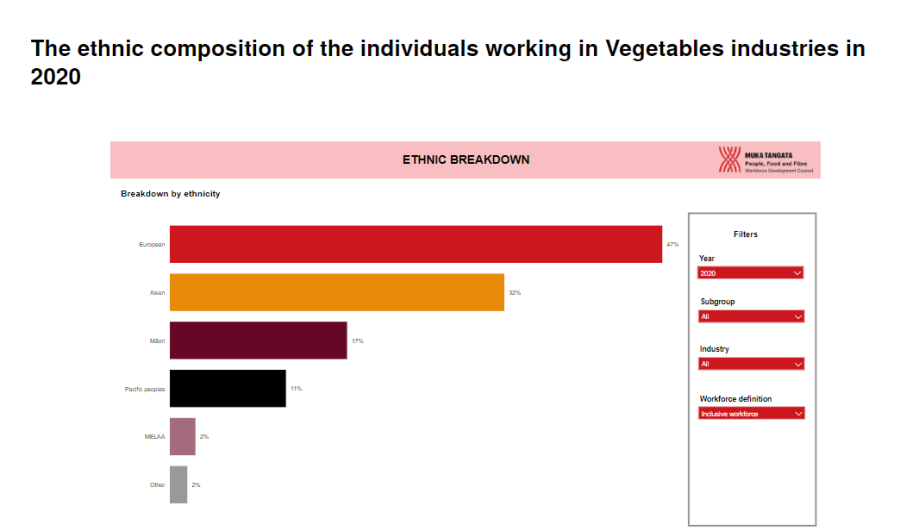

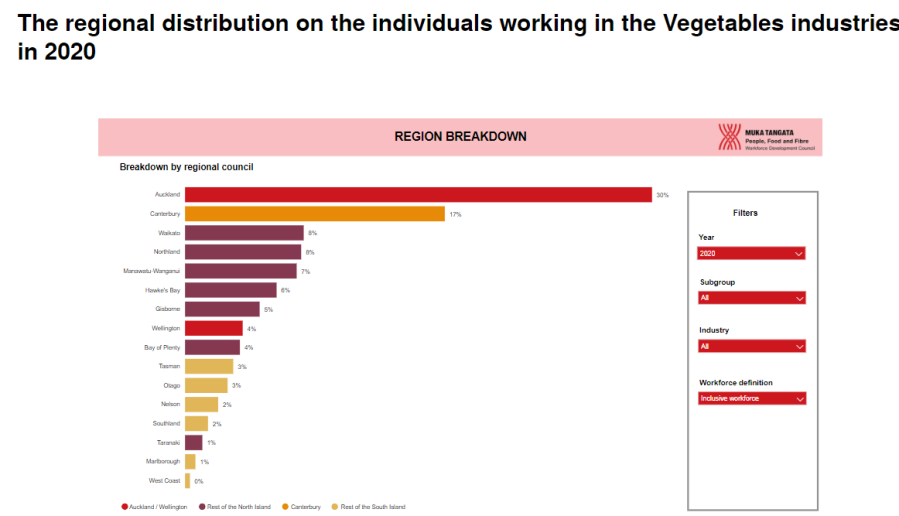

Vegetable workforce overview and highlighted demographics

12,710 people worked in the Vegetable industry in 2020 with people who identify as Asian making up over a third of the Vegetable industry’s workforce, especially in Mushroom Growing (63%) and Fruit and Vegetable Retailing (49%), while Māori make up 19% of the Outdoor Vegetable Growing workforce. Over 10% Pacific peoples also contribute to the workforce, with 16% who work in Under Cover Vegetable Growing, and 12% in Outdoor Vegetable Growing. Auckland is a key region for Under Cover Vegetable Growing, the rest of the North Island for Outdoor Vegetable Growing and Fruit and Vegetable Retailing, whereas Canterbury is the key region for Mushroom Growing2. The Vegetable workforce has a high reliance on temporary and work visa holders with 7% comprising Work Visa holders and a further 7% on Working holiday visas in 20203. This makes it vulnerable to changes in immigration trends and policy shifts.

Vegetable workforce forecasts

MPI forecasts, using the conservative ‘BAU Scenario’, are for an increase in worker numbers – particularly in higher skill level roles. Within the Vegetable workforces, the ‘Vegetable Growing’ area has significant season variation – this affects how forecasts should be interpreted as the forecasts below are based on a version of an annual ‘full time equivalent’ and therefore will underrepresent the number of actual workers forecast to be in the sector. We have mapped these forecasts to the roles and related qualifications for each of our industries and used them as an input to the level of increase requested for each qualification. See Appendix A: Translating MPI workforce forecasts to learner enrolment numbers for more details.

Vegetable workforce retention and tenure

The Vegetable workforce has a low level of new entrant retention and a low level of industry tenure. This replacement demand also is a driver of training requirements in this industry. This training is not lost to the sector – over a third of new entrants to Muka Tangata industries come from another food and fibre industry and our qualifications are increasingly focused on transferable skills. Specialised education and retention are associated with retention – so increased training is expected to support retention within the industry and broader sector.

Footnotes

2. Vegetables » Muka Tangata Workforce Development Council (workforceskills.nz)

3. See Figure 5 Source Stats NZ Census 2018 skill and workforce analysis 2023 (forthcoming)